A Different Kind of Economic “Bubble”

A Different Kind of Economic “Bubble” by Sheila Kennedy.

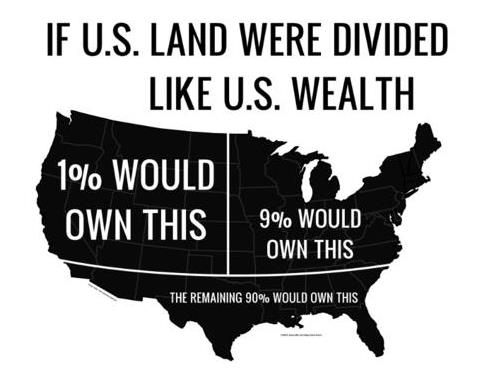

Some interesting points Sheila makes in her class, based on the book “The Price of Inequality: How Today’s Divided Society Endangers Our Future” by Joseph Stiglitz on how the 1% rig the economic system to continuously give themselves an advantage:

According to Stiglitz, the vaunted American market is broken. It has been overwhelmed by politically engineered market advantages—special deals that economists call “rent-seeking.” The term refers to politically-achieved “exemptions” from the market that allow certain individuals to reap economic returns above normal market levels– profits derived from favorable political treatment rather than competitive success.

And another point – business and the wealthy shuffle off the cost of their business production onto the commons, making taxpayers bear the cost:

Stiglitz also argues that much of the rent-seeking that plagues our economy takes a more subtle form. In many cases, the production of a product produces what economists call “negative externalities.” These are costs that are incurred during the manufacturing or development process that end up being imposed on society rather than paid for by the producer and included in the price of the goods or services involved. The most commonly cited example would be a manufacturer who discharges his waste into a nearby waterway rather than properly disposing of it, shifting the costs of cleanup and disposal to others. Society pays for the pollution, and that cost is not included in the market price of the manufactured goods.

Sounds like an interesting book and an interesting course.